A peer-to-peer (P2P) lending platform is the perfect solution if you’re interested in investing in a business loan and earning interest on the repayments. This type of investment will give you a reliable income stream. But before you rush into it, ensure that you are dealing with a reputable and trustworthy P2P lending platform.

Small businesses are often frustrated and disheartened when turned away from banks. Fortunately, there is an alternative source of funding for startups—a peer-to-peer lending platform. And it can do more than solve entrepreneurs’ financial woes. It’s also an excellent investment opportunity for savvy investors.

This is your guide to peer-to-peer lending, including reviews of the 12 top peer-to-peer lending platforms.

Peer-To-Peer Lending in a Nutshell

Peer-to-peer loans are, essentially, loans, and can range from personal, medical, or tuition loans to business loans. They are suitable for borrowers like entrepreneurs and startups who would usually not qualify for a business loan or personal loan from traditional financial institutions.

Lenders benefit from passive income when investing in P2P lending. This is a major incentive, as they typically earn higher interest when they lend money than they would from depositing it in a conventional savings account. Additionally, loan diversification helps to minimize the risks of loan defaults.

A peer-to-peer loan opportunity is accessed via a P2P lending platform. Here, approved businesses, who need to borrow money, can find a reliable peer-to-peer lender. The platform provides a direct connection between borrowers and investors and facilitates the transactions.

A P2P platform can also refer borrowers who match lenders’ set peer lending criteria. This could be criteria such as a maximum loan amount, minimum credit score, or location. Most P2P lenders have minimum credit score requirements.

Is Peer-To-Peer Lending the Same as Crowdfunding?

P2P loans offer benefits to both borrowers and lenders.

Lenders gain access to investments with good returns, as passive income. Borrowers, meanwhile, get the urgent funding they need. This could be for education, medical treatments, even expanding their businesses, or getting new creative projects off the ground.

P2P lending is also known as crowd-lending or social lending. It involves lending money at interest outside of the banking system. Crowdfunding is slightly different. The money is also raised online and outside of the banking system but in most types of crowdfunding, it is not repaid, or no interest is charged.

Why Peer-to-Peer Loans Are Better For Everyone

It’s easy to see why borrowers prefer P2P lending platforms. P2P lending is easier to access than with a traditional financial institution. Banks also generally have stringent loan regulations. Peer-to-peer loans also have more flexible terms than traditional personal loans.

But don’t worry. This does not increase investors’ risks. The best P2P lending platforms allow investors to match investments with their lending preferences. Plus, the platforms vet borrowers to minimize the lenders’ risks even further.

By investing in P2P lending, you earn an income from the interest on the loan, often more than if you’d earn on a savings account. Crowdfunding will not always give you a side income stream. That said, crowdlending (P2P lending), is a type of crowdfunding.

12 Top Peer-To-Peer (P2P) Lending Platforms

Peer-to-peer lending companies don’t just let people solve their financial problems and allow entrepreneurs and startups to secure the funding they need. They also offer investors an opportunity to make money, by financing loans.

The interest on these loans provides you, the investor, with a passive income. Best of all, while you’re earning a steady passive income, you’re helping your peers address urgent financial needs, pay for studies, or fund new businesses. However, you must use a trusted and reliable P2P platform.

There are many peer-to-peer platforms, some working within their own lending groups, and others doing so through a partnership with a lending group. So, how can you know which one is right for you? These are the 12 best P2P lending sites available to the European market.

1. Maclear AG

The Maclear P2P lending platform gives investors access to Swiss-regulated direct business investments with up to 14.9% interest rates. No deposit fees apply, and you can earn upwards of 1.5% cashback and a loyalty bonus of up to 2%.

Maclear AG is a registered member of PolyReg SRO. The platform complies with all anti-money laundering (AML), Know Your Client (KYC), and General Data Protection Regulation (GDPR) guidelines and requirements. Maclear is committed to lenders’ financial security. That’s why 2% of each funded project goes to the Maclear Provision fund.

Investors can proceed with confidence, knowing they will always receive their interest payments on time. A secondary market allows Maclear’s P2P investors to sell their investments before the end of the loan term. For even more convenience, a mobile app and auto-invest option are coming soon.

Maclear’s investors have total peace of mind about their security while transacting online. Data is protected by a range of security technologies and all accounts are protected by two-factor authentication(2FA).

2. Debitum Investments

The Debitum P2P lending platform allows investors to earn passive income on P2P loans with up to 15% annual percentage yield (APY). Debitum is licensed in the EU and is the first European P2P platform to invest in asset-backed securities (ABS).

There is no secondary investment market. On the Debitum platform, there are no investment fees, and an auto-invest option is available. To give investors more peace of mind, funds are protected up to €20,000. Cash-back bonuses are sometimes available.

3. Esketit

The Latvian-based Esketit P2P lending platform is affiliated with the Creamfinance group. Creamfinance LLC, founded in 2012 in Latvia, provides convenient consumer loans online. Via Creamfinance, Esketit has loan originators from multiple geographical regions. There is no platform use fee for investors.

Esketit allows its investors to confidently invest and earn passive income with consumer loans on the platform. It is the only European consumer lender with a large public bank as a strategic shareholder and practices total transparency. This gives investors peace of mind about investing on the platform.

4. Mintos

Mintos offers investors ready-to-go portfolios, with options to invest in loans, fractional bonds, EFTs, and real estate. Mintos Marketplace is based in Latvia and is the largest P2P lending platform in Europe. Investors find their mix of traditional investments and P2P lending opportunities appealing.

Its ready-to-go portfolios, automation features, and diversification options make P2P lending simple yet rewarding. There is no fee to use the platform, although a small monthly inactivity fee applies if you stop using it regularly. There is also a fee for currency conversions.

5. TWINO Investment Platform

TWINO is an alternative investment platform based in Latvia that offers P2P lending (consumer or business) and real-estate loan opportunities. Investors earn passive income through interest on these loans.

Loans are only available from TWINO Group, and only in Europe. This represents a slight drawback in investment opportunities for some investors. However, TWINO has a good reputation and offers many features that investors appreciate, like the auto-invest option.

6. Bondora Go & Grow

Bondora Go and Grow is a well-established European P2P lending platform. This user-friendly, automated, online investment platform is based in Estonia, and allows easy investing, even for beginners, with no annual management fees.

When you invest money on the Go & Grow platform, the funds are used to finance loans within Bondora’s various loan operations. A diversified portfolio means lower risk, and investors can enjoy returns of up to 6.75% per annum.

To invest on the Go & Grow platform, you must be a minimum of 18 years of age and have EU residency.

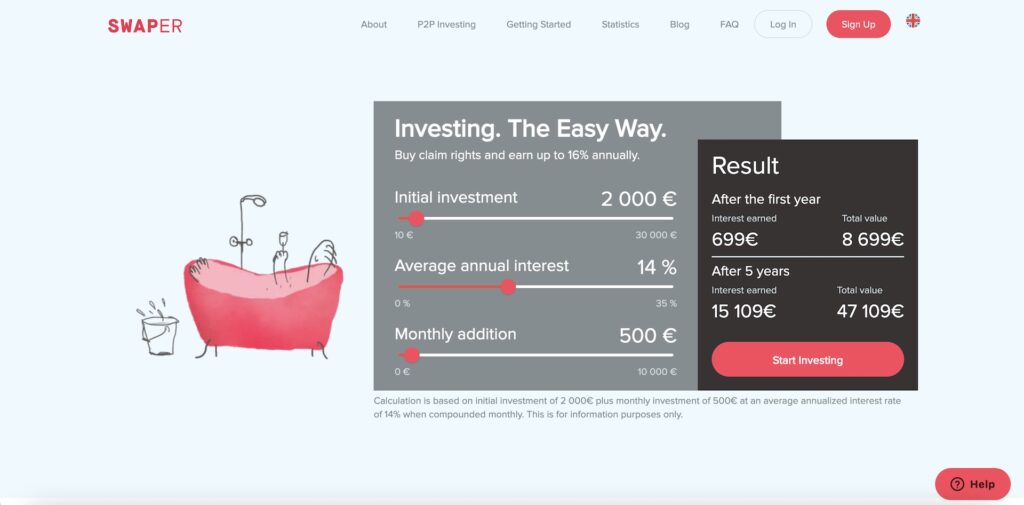

7. Swaper

Swaper is an Estonian platform that refinances short-term consumer loans issued by its parent company, Wandoo Finance Group. Loans are available from Denmark, Georgia, Poland, Russia and Spain.

The platform is not regulated and is only available in Europe. However, there is a 60-day buyback guarantee on loans, a secondary market is available, and returns appear stable. Investors can open an account on Swaper in either EUR or GBP to avoid money transfer fees.

Investors pay no platform investment fees and can select an auto-invest option.

8. iuvo Group

The iuvo Group P2P investing platform is based in Estonia. The platform is available worldwide and in 2020, a real-time currency exchange was added to the platform. There is no investment fee, and an auto-invest option is available.

Investors will be confident in using the platform, as it is part of a major finance group, is regulated, and offers a buyback guarantee.

However, investors must have a bank account in the EU or countries with anti-money laundering (AML)/Combating the Financing of Terrorism (CFT) systems equivalent to the EU. These practices require banks to collect clients’ identifying information and determine the origins of significant funds.

9. AxiaFunder

AxiaFunder is based in the UK and operates in over 227 countries worldwide. The platform provides investment opportunities in commercial litigation crowdfunding for professional, high-net-worth investors. This is non-correlated to the broader market. A secondary market is available.

Unlike typical P2P platforms, a high minimum investment is required.

Investors get access to legal cases with the potential to yield attractive risk-adjusted returns. Admittedly, AxiaFunder is not strictly in the same category as most P2P loan investment sites. However, P2P lenders who wish to diversify their investments may see it as an investment platform to consider.

10. LANDE

LANDE is a crowdfunding platform that focuses on agricultural development. The platform is based in Latvia and has very good ratings on Trustpilot. Investors can invest in European agricultural projects, and earn a good return just as they would on other P2P lending sites.

Even though the agricultural sector represents only a fraction of the EU’s total economy, investing in agricultural projects can be profitable. Although LANDE’s diversification options are limited, the loans are backed by assets and every project carries 5% co-funding.

An auto-invest option and a secondary market are also available.

11. PROFITUS

PROFITUS is a real estate crowdfunding and investment platform that is based in Lithuania. The platform operates throughout Europe and is licensed and supervised by the Bank of Lithuania as a crowdfunding operator.

Although Profitus describes itself as a crowdfunding platform, it does offer investment opportunities. Investors have access to a wide range of real estate crowdfunding projects. Property is often seen as a lucrative investment avenue, and this is yet another way to earn a side income from real estate.

For investors’ protection, all projects listed on the platform are first verified and selected by experts, and a mortgage is required as collateral for the investors. The average annual return is about 12.14%.

12. CG24 Group

CG24 is an online platform based in Switzerland that arranges financing of private and small business loans. Private, business and real estate loans are available. CG24 Group offers an alternative asset class with a low correlation to the financial markets, reducing investors’ risk.

Swiss bank account holders, excluding United States citizens, can invest on the CG24 P2P lending platform. A comprehensive tax statement is provided annually, at no extra charge. CG24 Group is subject to the Swiss Money Laundering Act and may, when necessary, request clarification about the origin of investors’ funds.

Conclusion

Investing in a P2P lending platform could be the opportunity for a passive income you have been looking for. P2P lending can earn you good returns on loans. But you must choose the platform carefully, to invest with confidence and reduce your risk.

The Maclear P2P lending platform offers everything you are looking for in a P2P lending platform.

You have access to convenient online investing with investor protection, regulatory compliance, data security, financial security, and innovation. Plus, it was founded by people with the expertise that counts — in business consulting, loan management, capital investment, and project selection.

You can trust Maclear for safe, secure, and rewarding P2P investment opportunities. Register an account and start investing today.